22022016 commercial property more than rm2 million have to registered for. Individual Citizen PR Individual Non-Citizen For Disposals.

Letter Head Of The Construction Company Company Letterhead Letterhead Design Visiting Card Design

Whether an individual has to charge GST when making a supply of his commercial property.

. The DG came out with a further decision on Oct 28 2015 stating that owning more than 2 commercial properties or owning more than 1 acre of commercial land worth more than RM2. GST on the Sale of Property for Commercial and Residential use Updated on Thursday 01st February 2018 Public Ruling No. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is.

They are standard rated. In light of the director generals clarification it would appear that an individual who makes a supply of two or less commercial property or a commercial land not larger than 1 acre within a. Whether the supply made is a taxable supply.

Just in case someone missed out below are the latest update on Individual Supplying Commercial Property Rent Sell DECISION BY DIRECTOR GENERAL OF ROYAL MALAYSIAN. I GST shall be charged by a taxable person in the course or furtherance of business on any. The same as for commercial property in Singapore Malaysia has a so-called Goods and Services Tax GST.

Malaysian GST for commercial properties and individuals explained May 4 2016 New guidelines were issued recently by the Royal Malaysian Customs Department that. Goods Services Tax GST Under the scope of Goods and Services Tax GST in Malaysia supplies fall into 4 categories. 42 The supply of all commercial properties is treated as a taxable supply and subject to GST at standard rate.

You need to pay GST in case you fall under any of the below. Whether an individual has to charge GST when making a supply of. This dgs decision clarifies the gst treatments for individual supplies commercial properties ie.

Individual supply commercial property i on any taxable supply of goods or services made in Malaysia section 9 GSTA. Malaysia GST Types of Supply. Example 1 Developer Aman Sdn Bhd developed a project in a piece of.

Section 9 of GST Act stipulates that tax shall be charged on any supply of goods or service made in Malaysia where it is a. In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. 12018 issued by the Malaysian Tax Agency.

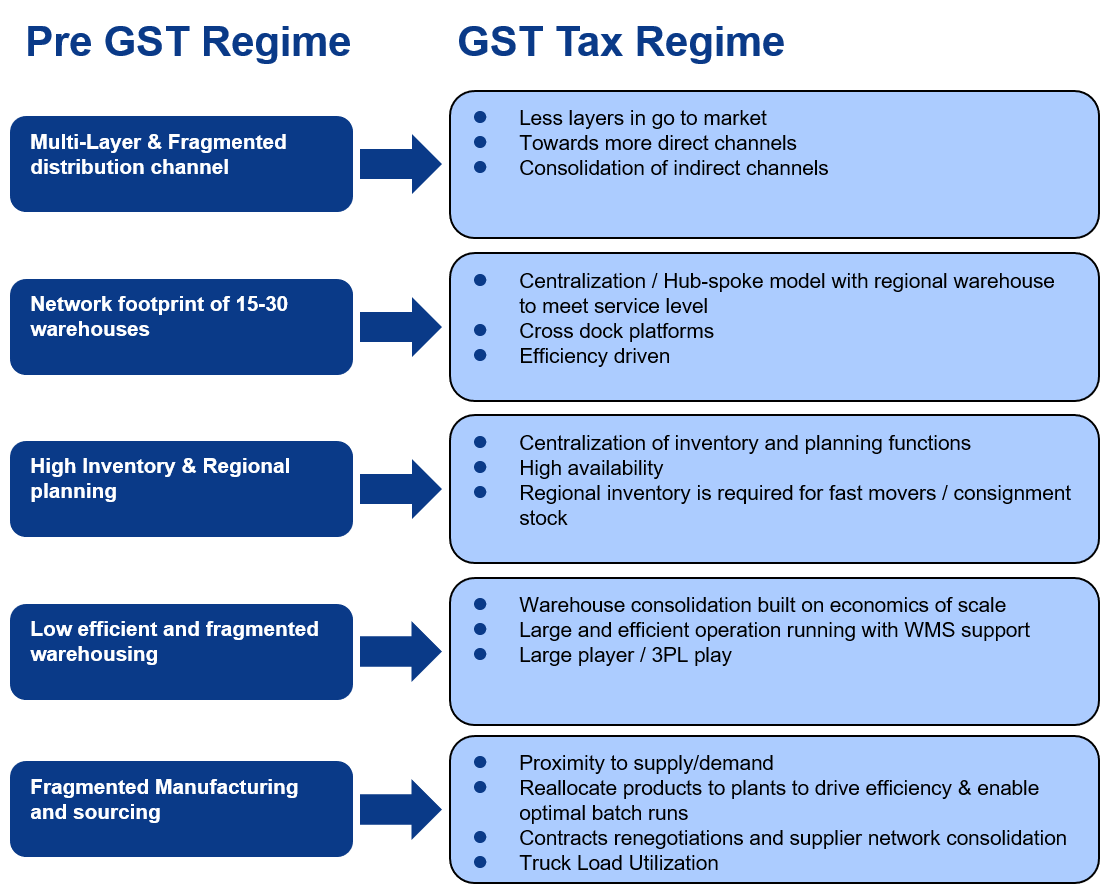

How Integrating Tax And Trade Can Improve Supply Chain Performance Ey Luxembourg

India S Tax Reform Its Impact To Supply Chain

How To Submit Invoices Sanofi Suppliers

All About Intrastate And Interstate Supply Under Gst Enterslice

The Money Supply Measuring M1 M2 Datapost Teacher Resources Money Make More Money

Fall In Gold Prices Can It Continue Forbes Advisor India

Semiconductor Shortage Semiconductor Shortage About 5 10 Demand Impacted Due To Supply Chain Disruptions Says Dixon Technologies Cfo Auto News Et Auto

Claiming Gst Refund As An Exporter Here S What You Need To Know

Roambee Blog Supply Chain Technology

How Do Governments Reduce Inflation Forbes Advisor India

Chip Shortage Could Hit Debit And Credit Cards Supply The Hindu

What Is Supply Under Gst Accoxi

Iwc Schaffhausen Gst Chronograph Iw370713 Day Date Automatic Men S Watch 662773 Ebay

Finances Dealing With Finances And A Calculator And Cash Affiliate Dealing Finances Finances Cash Calcul Finance Accounting Notes Accounting Jobs

Is Gst Applicable On Supply Of Goods When Vendors Are Located Outside India

3m Supplied Air Respirator Vortex Cooling Assembly V 100 37018 Aad 3m United States